Current crypto prices

Top Crypto Losers

Crypto prices are largely determined by the supply-demand balance between buyers and sellers. Most cryptocurrencies are distributed and limited by max supply. The higher the demand for a cryptocurrency, the higher its price will be. If a cryptocurrency is in low demand, the price decreases. When supply and demand are equal, the market is stable. Price cryptos The GMX price rose 3.15% to $33.14 as of writing on September 18. The last 24-hour volume of the crypto surged 41.34% to $8,565,173. Meanwhile, there is no apparent news for the recent surge in the crypto’s price.

Cryptocurrency price usd

The crypto world is riddled with numbers — cryptocurrency prices and their all-time highs, trading volumes, number of tokens in circulation, market capitalization, the list goes on. Making sense of these numbers can be a daunting task that becomes even more complicated when the numbers from different sources do not match. BREAKING: Coinbase and Crypto.com In Talks to Acquire Bankrupt FTX Europe A moving average (MA) is one of the most commonly used types of technical indicators and essentially cuts out the noise by generating an average price for a given cryptocurrency. Moving averages can be adjusted to periods and offer useful signals when trading in real-time crypto charts.

Cryptocurrency prices for the crypto market

The stronger association between crypto and equities is also apparent in emerging market economies, several of which have led the way in crypto-asset adoption. For example, correlation between returns on the MSCI emerging markets index and Bitcoin was 0.34 in 2020–21, a 17-fold increase from the preceding years. Check and compare cryptocurrency prices. Find out how much your bitcoins are worth, or compare prices, and check market cap. You can check the prices for Ethereum, Litecoin, Ripple, Dogecoin across all the top Indian exchanges here. Bitcoin volatility explains about one-sixth of S&P 500 volatility during the pandemic, and about one-tenth of the variation in S&P 500 returns. As such, a sharp decline in Bitcoin prices can increase investor risk aversion and lead to a fall in investment in stock markets. Spillovers in the reverse direction—that is, from the S&P 500 to Bitcoin—are on average of a similar magnitude, suggesting that sentiment in one market is transmitted to the other in a nontrivial way.

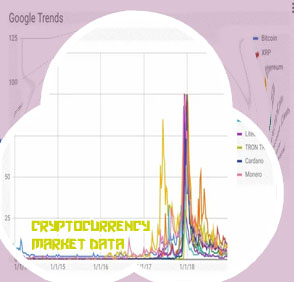

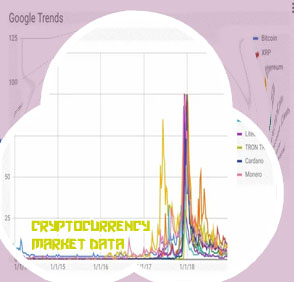

Cryptocurrency prices chart

Please be aware that some of the links on this site will direct you to the websites of third parties, some of whom are marketing affiliates and/or business partners of this site and/or its owners, operators and affiliates. We may receive financial compensation from these third parties. Notwithstanding any such relationship, no responsibility is accepted for the conduct of any third party nor the content or functionality of their websites or applications. A hyperlink to or positive reference to or review of a broker or exchange should not be understood to be an endorsement of that broker or exchange’s products or services. Ethereum Price History Remember, these contracts are just switches. If this happens, then do that. But these switches can work in series, creating powerful applications. Imagine flipping the light switch in your living room, and the TV starts streaming your favorite Netflix vampire show while a robot you didn’t know you had brings you fresh-popped popcorn. Smart contracts can trigger multiple actions if defined conditions are met.